Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

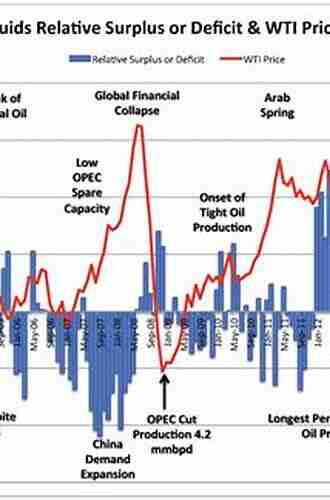

World Market Price Of Oil - Impact on Global Economy

The world market price of oil has a significant impact on the global economy, influencing various sectors and affecting the daily lives of individuals worldwide. As a crucial resource for energy and transportation, fluctuations in oil prices can drastically alter economic conditions, trade patterns, and geopolitical dynamics.

The Importance of Oil in the Global Economy

Oil is an essential commodity that drives the global economy. It serves as the primary source of energy for industries, transportation, and households. The demand for oil is consistently high, making it a valuable resource traded on the international market. Its fluctuating price impacts numerous sectors and has far-reaching consequences.

The Factors Influencing Oil Prices

Several factors influence the world market price of oil. Supply and demand dynamics play a crucial role in determining prices. Production levels of major oil-producing countries, such as Saudi Arabia, the United States, Russia, and others, significantly impact supply. Instability in oil-rich regions, production disruptions, and geopolitical tensions can disrupt the supply chain, causing price spikes.

4.1 out of 5

| Language | : | English |

| File size | : | 11836 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 204 pages |

On the other hand, global economic growth, industrialization, and changes in energy consumption patterns affect demand. Emerging economies, like China and India, have witnessed rapid industrial growth, resulting in increased demand for oil. Any major changes in economic activities worldwide can cause fluctuations in oil prices.

Impact on the Global Economy

The world market price of oil has both direct and indirect impacts on the global economy. Let's explore some key areas affected:

1. Energy Costs

Oil prices directly influence the costs of energy production and consumption. Fluctuations in oil prices indirectly affect the prices of electricity, gasoline, and other energy sources. When oil prices rise, it leads to higher energy costs, impacting both individuals and businesses. Increased energy costs often result in higher production costs across various industries, leading to inflationary pressures.

2. Inflation

Oil price hikes can contribute to inflationary pressures. As the costs of transportation and production increase, businesses pass on the additional costs to consumers, leading to higher prices for goods and services. Higher inflation can reduce consumers' purchasing power and impact the overall economic stability.

3. Import-Export Balance

Changes in oil prices can affect import-export dynamics between nations, especially for major oil importers and exporters. Higher oil prices can result in increased import bills for oil-importing countries, affecting their trade balance. Conversely, oil-exporting countries benefit from higher oil prices, leading to improved trade balances and increased revenues.

4. Stock Market Volatility

Oil price fluctuations often lead to increased stock market volatility. Oil companies, energy-dependent industries, and related sectors experience significant fluctuations in stock prices. The profitability of oil companies is directly tied to oil prices, impacting investor sentiment and overall market stability.

5. Geopolitical Dynamics

Oil is a strategic resource that often influences geopolitical dynamics. Countries with significant oil reserves hold considerable economic and political power. Oil-rich regions become magnets for geopolitical conflicts and power struggles. Disruptions in oil supply due to conflicts, sanctions, or political instability can cause regional tensions and have far-reaching consequences.

Measuring Oil Price Fluctuations

Several benchmark crude oil prices are used to measure oil price fluctuations. The most notable benchmarks include the Brent crude oil price and the West Texas Intermediate (WTI) crude oil price. Brent crude oil is sourced from the North Sea, and its price is widely used in global oil trade. WTI crude oil is extracted in the United States and serves as the benchmark for oil prices within the country.

The world market price of oil is a critical factor influencing the global economy. Understanding the factors driving oil prices and their impact on different sectors helps us comprehend the intricate relationship between oil and economic dynamics. It is essential for governments, businesses, and individuals to remain vigilant about oil price fluctuations and devise strategies to mitigate potential challenges in an increasingly interconnected global marketplace.

4.1 out of 5

| Language | : | English |

| File size | : | 11836 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 204 pages |

This book develops new econometric models to analyze and forecast the world market price of oil. The authors construct ARIMA and Trend models to forecast oil prices, taking into consideration outside factors such as political turmoil and solar activity on the price of oil. Incorporating historical and contemporary market trends, the authors are able to make medium and long-term forecasting results. In the first chapter, the authors perform a broad spectrum analysis of the theoretical and methodological challenges of oil price forecasting. In the second chapter, the authors build and test the econometric models needed for the forecasts. The final chapter of the text brings together the s they reached through applying the models to their research. This book will be useful to students in economics, particularly those in upper-level courses on forecasting and econometrics as well as to politicians and policy makers in oil-producing countries, oil importing countries, and relevant international organizations.

Fernando Pessoa

Fernando PessoaThe Ultimate Guide to New Addition Subtraction Games...

In this day and age, countless parents are...

Ethan Mitchell

Ethan MitchellThe Ultimate Guide for the Aspiring Pianist: Unleash Your...

Are you a beginner pianist feeling...

Gerald Parker

Gerald ParkerWow Robot Club Janice Gunstone - The Mastermind Behind...

Robots have always fascinated...

Dylan Hayes

Dylan HayesIdeal For Catching Up At Home: CGP KS2 Geography

Are you looking for the perfect resource to...

Kevin Turner

Kevin TurnerThe Ultimate Pictorial Travel Guide To Vietnam: Explore...

Discover the rich...

D'Angelo Carter

D'Angelo CarterUnlocking the Secrets of Compact Stars: Exploring...

Compact stars have...

Isaiah Price

Isaiah PriceUnveiling the Hidden Gem: Google Places Goliath Valley...

Are you tired of visiting the same old...

Donald Ward

Donald WardEssays Towards Theory Of Knowledge: Exploring the Depths...

Are you ready to delve into...

Thomas Mann

Thomas MannThe Ultimate PMP Project Management Professional All In...

Are you ready to take your project...

Trevor Bell

Trevor Bell10 Incredible Stories From Life In Football That Will...

The Beautiful Game - Football...

Zachary Cox

Zachary Cox100 Amazing And Unexpected Uses For Coconut Oil

Coconut oil, a versatile and widely loved...

Owen Simmons

Owen SimmonsUnveiling the Enigma of Die Blaue Brosche: A Family’s...

Have you ever heard of Die Blaue Brosche...

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

Dalton FosterThe Fascinating World of Common Bees in Eastern North America: Discovering...

Dalton FosterThe Fascinating World of Common Bees in Eastern North America: Discovering...

Carlos FuentesThe Complete Guide to Fundamentals of Site Remediation: Expert Insights by...

Carlos FuentesThe Complete Guide to Fundamentals of Site Remediation: Expert Insights by...

Felipe BlairUnveiling the Untold Story of Anglo Danish Military Collaboration: A Journey...

Felipe BlairUnveiling the Untold Story of Anglo Danish Military Collaboration: A Journey... Enrique BlairFollow ·3.8k

Enrique BlairFollow ·3.8k Amir SimmonsFollow ·2.1k

Amir SimmonsFollow ·2.1k Chris ColemanFollow ·16.1k

Chris ColemanFollow ·16.1k Desmond FosterFollow ·12.5k

Desmond FosterFollow ·12.5k Tennessee WilliamsFollow ·13.2k

Tennessee WilliamsFollow ·13.2k Samuel BeckettFollow ·3.2k

Samuel BeckettFollow ·3.2k Herman MelvilleFollow ·11.9k

Herman MelvilleFollow ·11.9k Rick NelsonFollow ·15.6k

Rick NelsonFollow ·15.6k