Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

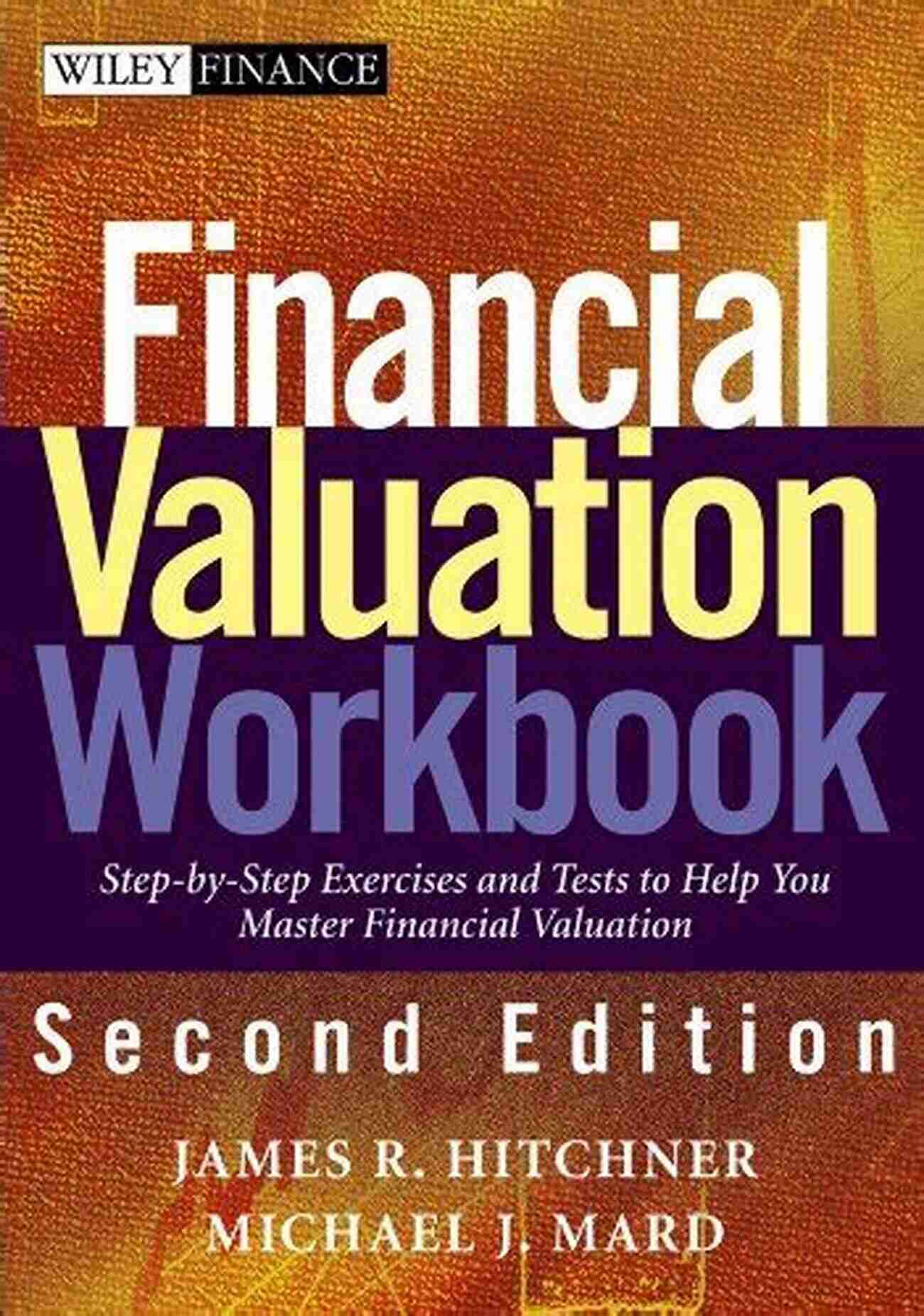

Step By Step Exercises To Help You Master Financial Valuation Wiley Finance 333

Are you looking to enhance your understanding of financial valuation? Do you want to master the techniques and principles that go behind evaluating the worth of an investment or a business? Look no further, as this comprehensive guide will provide you with step-by-step exercises to help you become a financial valuation expert.

to Financial Valuation

Financial valuation plays a crucial role in the world of finance. It involves estimating the monetary worth of assets, investments, or businesses. This process is essential for various purposes, including making investment decisions, conducting mergers and acquisitions, and assessing the value of a company for financial reporting purposes.

Mastery of financial valuation requires a solid foundation in finance and a deep understanding of valuation methodologies. By following these step-by-step exercises outlined below, you can develop the necessary skills to become proficient in financial valuation.

4.1 out of 5

| Language | : | English |

| File size | : | 5106 KB |

| Text-to-Speech | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 384 pages |

| Lending | : | Enabled |

| Screen Reader | : | Supported |

Step 1: Building Your Financial Knowledge

Before diving into the complexities of financial valuation, it is crucial to have a strong understanding of the fundamental concepts in finance. This includes topics such as time value of money, risk and return, financial statement analysis, and basic accounting principles. Familiarize yourself with these concepts through online courses, textbooks, or by consulting finance experts.

Step 2: Choosing the Right Valuation Approach

There are multiple approaches to valuing assets or businesses, including the discounted cash flow (DCF) method, market multiples method, and asset-based approach. Each method has its own advantages and limitations. It is essential to learn about these approaches and understand when to use each one based on the context and nature of the valuation.

Step 3: Understanding Financial Statements

Financial statements such as income statements, balance sheets, and cash flow statements are crucial for conducting a valuation. They provide insights into the financial health, performance, and cash flow generation of a business. Learning how to analyze and interpret these statements will enhance your ability to assess the value of a company accurately.

Step 4: Performing Valuation Calculations

With a solid foundation in finance and understanding of valuation approaches and financial statements, it's time to dive into performing valuation calculations. This involves applying the chosen valuation method to a specific case study or real-world company. Start with simple exercises that focus on a single valuation approach and then progress to more complex exercises that require combining multiple methods.

Step 5: Critically Evaluating Valuation Results

Once you have performed your valuation calculations, it is crucial to critically evaluate the results. Assess the reasonableness of your assumptions, consider the impact of different scenarios, and compare your valuation results with market data or industry benchmarks. This step helps refine your valuation skills and ensures that you are making sound judgments in determining the worth of an asset or business.

Step 6: Seeking Feedback and Continuous Learning

Continuous learning is key to mastering financial valuation. Seek feedback from professionals in the field, attend valuation workshops or conferences, and stay updated with the latest trends and developments in valuation methodologies. Engaging in discussions and networking with experts will provide valuable insights and enable you to refine your skills further.

Becoming an expert in financial valuation requires dedication, continuous learning, and practice. By following the step-by-step exercises outlined in this guide, you will be on your way to mastering the art of financial valuation. Remember to stay persistent, seek feedback, and embrace the ever-evolving landscape of finance. Start your journey today and become a sought-after financial valuation specialist with the help of Wiley Finance 333.

4.1 out of 5

| Language | : | English |

| File size | : | 5106 KB |

| Text-to-Speech | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 384 pages |

| Lending | : | Enabled |

| Screen Reader | : | Supported |

Ghe complete resource to guide professionals through a full business valuation and to better manage their practice.

Now valuation professionals can master every function for every valuation situation. The Financial Valuation Workbook, Second Edition guides readers through a complete business valuation with essential tools for quick reference.

Completely revised and updated, this practical guide applies valuation theory to real-world business environments and provides a detailed case study, models, and exercises covering basic, intermediate, and advanced topics for readers at any valuation level.

Three new chapters have been added. Chapter 3, "Companion Exercises and Test Questions," includes over 300 exercises that can be used to prepare for business valuation certification exams or by professors as reinforcement of the material presented in Financial Valuation Applications and Models. Chapter 6, "Marketing, Managing, and Making Money," presents marketing and staff management tips and highlights risk management in regard to reports and engagements letters with examples. Chapter 7, "Practice Management Workflow Procedures," starts with the initial prospective client call, ends with billing, and provides checkpoints throughout the entire valuation management process.

This Workbook is organized by standard, easily identifiable sections that allow for easy reference by all professionals. This accessible text:

- Covers step by step the intricacies of preparing a credible valuation

- Guides the less experienced valuation practitioner through concepts and applications

- Includes helpful resources such as information requests, thirty-seven checklists, and other tools to assist valuation practitioners

The authors also include a chapter of helpful "ValTips" submitted by thirty leading valuation experts. CPAs, appraisers, attorneys, merger and acquisition professionals, professors, and students will find the Financial Valuation Workbook, Second Edition to be an essential resource.

Fernando Pessoa

Fernando PessoaThe Ultimate Guide to New Addition Subtraction Games...

In this day and age, countless parents are...

Ethan Mitchell

Ethan MitchellThe Ultimate Guide for the Aspiring Pianist: Unleash Your...

Are you a beginner pianist feeling...

Gerald Parker

Gerald ParkerWow Robot Club Janice Gunstone - The Mastermind Behind...

Robots have always fascinated...

Dylan Hayes

Dylan HayesIdeal For Catching Up At Home: CGP KS2 Geography

Are you looking for the perfect resource to...

Kevin Turner

Kevin TurnerThe Ultimate Pictorial Travel Guide To Vietnam: Explore...

Discover the rich...

D'Angelo Carter

D'Angelo CarterUnlocking the Secrets of Compact Stars: Exploring...

Compact stars have...

Isaiah Price

Isaiah PriceUnveiling the Hidden Gem: Google Places Goliath Valley...

Are you tired of visiting the same old...

Donald Ward

Donald WardEssays Towards Theory Of Knowledge: Exploring the Depths...

Are you ready to delve into...

Thomas Mann

Thomas MannThe Ultimate PMP Project Management Professional All In...

Are you ready to take your project...

Trevor Bell

Trevor Bell10 Incredible Stories From Life In Football That Will...

The Beautiful Game - Football...

Zachary Cox

Zachary Cox100 Amazing And Unexpected Uses For Coconut Oil

Coconut oil, a versatile and widely loved...

Owen Simmons

Owen SimmonsUnveiling the Enigma of Die Blaue Brosche: A Family’s...

Have you ever heard of Die Blaue Brosche...

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

Craig BlairThe Rivalries, Clashes, and Conflicts That Forged a Nation: Father's Day Gift...

Craig BlairThe Rivalries, Clashes, and Conflicts That Forged a Nation: Father's Day Gift...

Shane BlairThe Ultimate Guide to Brahmacarya in Krsna Consciousness: Achieving Spiritual...

Shane BlairThe Ultimate Guide to Brahmacarya in Krsna Consciousness: Achieving Spiritual... Joel MitchellFollow ·2.5k

Joel MitchellFollow ·2.5k George R.R. MartinFollow ·16.9k

George R.R. MartinFollow ·16.9k Gary ReedFollow ·8.6k

Gary ReedFollow ·8.6k Adrien BlairFollow ·12.4k

Adrien BlairFollow ·12.4k Al FosterFollow ·10.9k

Al FosterFollow ·10.9k Fernando BellFollow ·12.2k

Fernando BellFollow ·12.2k Edgar CoxFollow ·2.7k

Edgar CoxFollow ·2.7k Johnny TurnerFollow ·19.6k

Johnny TurnerFollow ·19.6k