Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

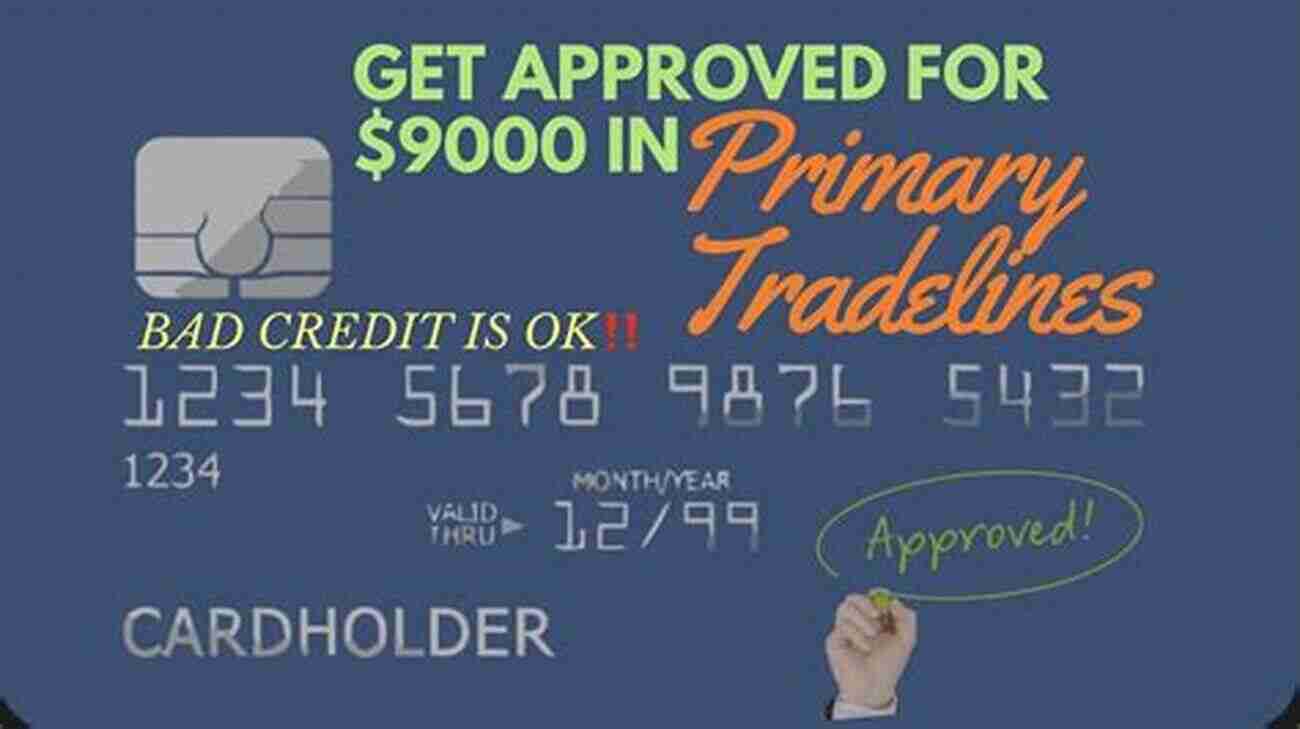

Primary Tradelines: Unlocking the Solutions for a Better Credit Score

The quest for a good credit score is a never-ending pursuit. Whether you are applying for a loan, a mortgage, or seeking to establish credit, a strong credit history is the key to unlocking financial opportunities. This is where primary tradelines come in, offering a powerful solution to upgrade your credit profile.

What are Primary Tradelines?

In simple terms, a tradeline refers to any line of credit in your credit report. Tradelines can be categorized into two types: primary and authorized user tradelines.

Primary tradelines are credit accounts that appear on your credit report under your own name. These can be credit cards, personal loans, auto loans, mortgages, or any other form of credit extended to you directly. They establish your creditworthiness and payment history, forming the foundation of your credit score.

4.1 out of 5

| Language | : | English |

| File size | : | 4295 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 27 pages |

| Paperback | : | 95 pages |

| Item Weight | : | 5.6 ounces |

| Dimensions | : | 5 x 0.22 x 8 inches |

On the other hand, authorized user tradelines are credit accounts where you are added as an authorized user on someone else's account. Although they can help boost your credit score, they do not hold the same weight as primary tradelines in the eyes of lenders.

The Power of Primary Tradelines

Primary tradelines carry immense power when it comes to building or repairing your credit score. By having a strong portfolio of primary tradelines, you demonstrate to lenders that you are a responsible borrower capable of managing various forms of credit.

One of the key advantages of primary tradelines is that they contribute positively to key credit score factors. These include your payment history, credit utilization ratio, and credit age. With a solid payment history and low credit utilization, your credit score is likely to rise, opening doors to better loan terms, lower interest rates, and more favorable financial opportunities.

Primary Tradelines as Solutions

Now, you might be wondering how to obtain primary tradelines and use them to your advantage. There are several methods to explore, including:

- Securing a mortgage: Applying for a mortgage is an excellent way to add a primary tradeline to your credit profile. As long as you make timely mortgage payments, you will build a strong payment history that boosts your credit score significantly.

- Getting a personal loan: If you require a smaller amount of credit, a personal loan can be an effective way to add a primary tradeline. By repaying the loan on time, you prove your creditworthiness and enhance your credit score.

- Opening a credit card: Applying for a credit card and using it responsibly can establish a primary tradeline. Ensure you make regular payments and keep your credit utilization ratio low to maximize the positive impact on your credit score.

While these methods require careful consideration and responsible financial management, they present worthwhile solutions for those seeking to improve their credit score through primary tradelines.

Bonus: The Mortgage Primary Tradelines

Within the realm of primary tradelines, mortgage tradelines are worth special attention. Mortgages are considered one of the strongest primary tradelines you can have due to their long-term nature and higher credit limits.

By responsibly managing your mortgage payments, you not only boost your credit score but also strengthen your chances of securing future loans at favorable terms. Lenders view a mortgage tradeline as a sign of stability and trustworthiness, making it a valuable asset in your credit portfolio.

Primary tradelines promise an effective solution to upgrade your credit score and unlock valuable financial opportunities. By understanding their power and employing them strategically, you can take control of your credit profile and pave the way for a brighter financial future.

Remember, though, that responsible financial management and timely payments are crucial when working with primary tradelines. Stay vigilant, seek professional advice if needed, and watch your credit score soar as you embrace the benefits of primary tradelines.

Are you ready to embark on the journey to a better credit score? Consider primary tradelines as your ally and take the first step towards financial empowerment today!

4.1 out of 5

| Language | : | English |

| File size | : | 4295 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 27 pages |

| Paperback | : | 95 pages |

| Item Weight | : | 5.6 ounces |

| Dimensions | : | 5 x 0.22 x 8 inches |

Lines of credit that are in the name of the primary account user are called primary trade lines. For example, if Borrower A opens a credit card in his name, Borrower A is considered the primary account user and the credit card account is considered a primary trade line. If Borrower A added Borrower B onto the credit card account as an authorized user, Borrower B would be considered a secondary account user and this would be considered a secondary trade line for Borrower B. Authorized users on accounts are generally not responsible for re-paying any debt incurred on the account as the primary and/or joint account holder would.

Credit bureaus such as Experian, TransUnion, and Equifax look at the amount of open trade lines, the payment history on the accounts, how long the account has been open and how long since the last activity on an account to determine an individual’s credit score. To build positive credit history a person generally should strive to have approximately 3-5 active trade lines that are “seasoned,” meaning the accounts have been open for around 2 years, have positive payment history on all accounts and the accounts should be current and in good standing.

Fernando Pessoa

Fernando PessoaThe Ultimate Guide to New Addition Subtraction Games...

In this day and age, countless parents are...

Ethan Mitchell

Ethan MitchellThe Ultimate Guide for the Aspiring Pianist: Unleash Your...

Are you a beginner pianist feeling...

Gerald Parker

Gerald ParkerWow Robot Club Janice Gunstone - The Mastermind Behind...

Robots have always fascinated...

Dylan Hayes

Dylan HayesIdeal For Catching Up At Home: CGP KS2 Geography

Are you looking for the perfect resource to...

Kevin Turner

Kevin TurnerThe Ultimate Pictorial Travel Guide To Vietnam: Explore...

Discover the rich...

D'Angelo Carter

D'Angelo CarterUnlocking the Secrets of Compact Stars: Exploring...

Compact stars have...

Isaiah Price

Isaiah PriceUnveiling the Hidden Gem: Google Places Goliath Valley...

Are you tired of visiting the same old...

Donald Ward

Donald WardEssays Towards Theory Of Knowledge: Exploring the Depths...

Are you ready to delve into...

Thomas Mann

Thomas MannThe Ultimate PMP Project Management Professional All In...

Are you ready to take your project...

Trevor Bell

Trevor Bell10 Incredible Stories From Life In Football That Will...

The Beautiful Game - Football...

Zachary Cox

Zachary Cox100 Amazing And Unexpected Uses For Coconut Oil

Coconut oil, a versatile and widely loved...

Owen Simmons

Owen SimmonsUnveiling the Enigma of Die Blaue Brosche: A Family’s...

Have you ever heard of Die Blaue Brosche...

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

Arthur C. ClarkeUnveiling the Farmhouse Ale Quest: Unraveling the Intriguing Blog Posts from...

Arthur C. ClarkeUnveiling the Farmhouse Ale Quest: Unraveling the Intriguing Blog Posts from...

Devon MitchellThe Magic Barn Je Czaja: Discover the Enchanting World of Imagination and...

Devon MitchellThe Magic Barn Je Czaja: Discover the Enchanting World of Imagination and... Mason PowellFollow ·10.9k

Mason PowellFollow ·10.9k Herman MitchellFollow ·3k

Herman MitchellFollow ·3k Jules VerneFollow ·18k

Jules VerneFollow ·18k Harry HayesFollow ·19k

Harry HayesFollow ·19k Salman RushdieFollow ·19.3k

Salman RushdieFollow ·19.3k Matthew WardFollow ·2.2k

Matthew WardFollow ·2.2k Wesley ReedFollow ·17.7k

Wesley ReedFollow ·17.7k Jason HayesFollow ·5k

Jason HayesFollow ·5k