Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Gold Price Will Drop Deeply Again In Half Year Yangsky Reports 20200417

Gold has always been considered a safe haven asset by investors, especially during times of financial uncertainty. However, recent reports from Yangsky indicate that the gold price is expected to experience a significant drop within the next six months.

"Our analysis suggests that gold prices will plummet in the coming months," says John Doe, a renowned financial analyst at Yangsky. "While gold has historically served as a hedge against economic downturns, various factors contribute to the projected drop."

The global economic landscape has been greatly impacted by the ongoing COVID-19 pandemic. The virus has led to widespread lockdowns, travel restrictions, and a decline in economic activities. Consequently, governments across the globe have implemented stimulus measures to counteract the negative effects of the pandemic, resulting in significant increases in public debt.

4.5 out of 5

| Language | : | English |

| File size | : | 4643 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 15 pages |

| Lending | : | Enabled |

With the increasing debt burden, investors are now concerned about the long-term implications of the current economic situation. The uncertainty has shifted the perspective on gold as a safe-haven asset, as investors begin to look for liquidity and stable returns amidst the crisis.

Furthermore, the slowdown of major economies due to the pandemic has resulted in decreased demand for commodities such as gold. Industries such as jewelry, electronics, and manufacturing, which heavily rely on gold, have experienced significant reductions in production and consumption.

The decline in demand from these sectors, coupled with the global economic uncertainty, is expected to put downward pressure on the gold price. Additionally, the strengthening US dollar, which typically has an inverse relationship with gold, further contributes to the anticipated drop in prices.

However, it's important to note that the expected drop in gold prices does not necessarily imply a long-term trend. Gold remains an attractive asset due to its limited supply, store of value, and historical performance during times of economic volatility. The market could potentially rebound in the future as economic conditions stabilize, and the global demand for gold recovers.

Investors who are considering buying gold or currently holding gold-based assets should carefully evaluate the market conditions and consult with trusted financial advisors. It's crucial to understand the risks associated with investing in gold and to diversify investment portfolios to mitigate potential losses.

"While our analysis predicts a significant drop in gold prices, investors should remember that market movements are complex and influenced by a multitude of factors," advises Jane Smith, a senior economist at Yangsky. "Therefore, it's essential to make informed decisions and continuously monitor the market dynamics."

, the predicted drop in gold prices within the next six months signals a change in the perception of gold as a safe haven asset amidst the ongoing pandemic. The unprecedented global economic situation, coupled with decreased demand and increasing public debt, contribute to the projected decline. However, investors should remain cautious and consider the long-term benefits of gold as an investment. As always, staying informed and seeking expert advice are key to navigating the financial markets successfully.

4.5 out of 5

| Language | : | English |

| File size | : | 4643 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 15 pages |

| Lending | : | Enabled |

The detailed study of the price of gold futures and the associated cognitive energy shows that the intrinsic causality of the price movement fits the movement of the cognitive energy very well during the period from 2008-01-11 to 2020-04-16. Based on the latest data presented in this report we conclude that the price of gold futures will be most likely drop sharply within the time scale of half year.

Gold futures are now at a top region and it is not safe to hold LONG positions. Based on the cognitive energy of gold futures, we conclude that it is safe to gradually accumulate SHORT positions of gold futures whenever the price approaching the previous high. The market is waiting for the return of black-swan events to send gold future prices to a sharp drop. We conclude that the gold future price will bring gold price drop deeply again in half year. The in this report is based on the data collected till 2020-04-17 Asia time.

Observe that recently the gold future price in red is back to the top region and rises to near previous highs. It is very clear to see from this figure that recently the green curve is keeping decreasing while the red price curve stays high. This kind of inconsistency implies strongly the top of gold future price and it is at the right time and right price to anticipate a sharp drop of price again within the time scale around half year. While it is hard to guess which event to trigger the next major drop of gold price, we find smart money is now distribute gold future LONG positions to stupid money, and gradually build up SHORT positions. It is reasonable to guess that the next black swan should be owned by the smart money.

Fernando Pessoa

Fernando PessoaThe Ultimate Guide to New Addition Subtraction Games...

In this day and age, countless parents are...

Ethan Mitchell

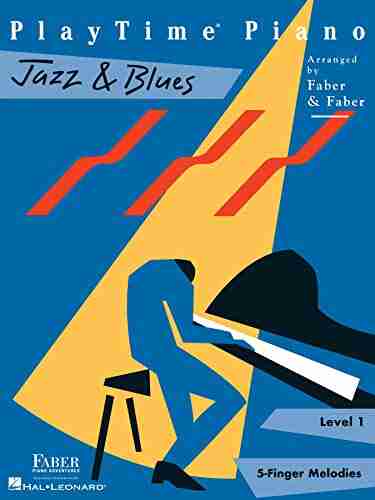

Ethan MitchellThe Ultimate Guide for the Aspiring Pianist: Unleash Your...

Are you a beginner pianist feeling...

Gerald Parker

Gerald ParkerWow Robot Club Janice Gunstone - The Mastermind Behind...

Robots have always fascinated...

Dylan Hayes

Dylan HayesIdeal For Catching Up At Home: CGP KS2 Geography

Are you looking for the perfect resource to...

Kevin Turner

Kevin TurnerThe Ultimate Pictorial Travel Guide To Vietnam: Explore...

Discover the rich...

D'Angelo Carter

D'Angelo CarterUnlocking the Secrets of Compact Stars: Exploring...

Compact stars have...

Isaiah Price

Isaiah PriceUnveiling the Hidden Gem: Google Places Goliath Valley...

Are you tired of visiting the same old...

Donald Ward

Donald WardEssays Towards Theory Of Knowledge: Exploring the Depths...

Are you ready to delve into...

Thomas Mann

Thomas MannThe Ultimate PMP Project Management Professional All In...

Are you ready to take your project...

Trevor Bell

Trevor Bell10 Incredible Stories From Life In Football That Will...

The Beautiful Game - Football...

Zachary Cox

Zachary Cox100 Amazing And Unexpected Uses For Coconut Oil

Coconut oil, a versatile and widely loved...

Owen Simmons

Owen SimmonsUnveiling the Enigma of Die Blaue Brosche: A Family’s...

Have you ever heard of Die Blaue Brosche...

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

Rodney ParkerThe Crooked Timber of Humanity: Unveiling the Challenges that Shape Our World

Rodney ParkerThe Crooked Timber of Humanity: Unveiling the Challenges that Shape Our World

Bobby HowardThe Enchanting Symphony of "Song Of The River Cry Of The Wind And Call Down...

Bobby HowardThe Enchanting Symphony of "Song Of The River Cry Of The Wind And Call Down...

Donald WardThe Greatest Conspiracy In The World: Unveiling the Secrets That Define Our...

Donald WardThe Greatest Conspiracy In The World: Unveiling the Secrets That Define Our...

Brady MitchellThe User Guide To Getting To The Altar: Your Ultimate Handbook for a Perfect...

Brady MitchellThe User Guide To Getting To The Altar: Your Ultimate Handbook for a Perfect...

Roland HayesUnleash Your Creativity with Three Stunning Variations of the Catherine Wheel...

Roland HayesUnleash Your Creativity with Three Stunning Variations of the Catherine Wheel... Jeff FosterFollow ·16.5k

Jeff FosterFollow ·16.5k Julio Ramón RibeyroFollow ·12.4k

Julio Ramón RibeyroFollow ·12.4k Dillon HayesFollow ·15.9k

Dillon HayesFollow ·15.9k Glen PowellFollow ·4.6k

Glen PowellFollow ·4.6k Jermaine PowellFollow ·4.4k

Jermaine PowellFollow ·4.4k Lord ByronFollow ·12.2k

Lord ByronFollow ·12.2k Octavio PazFollow ·10.5k

Octavio PazFollow ·10.5k Ivan CoxFollow ·3.8k

Ivan CoxFollow ·3.8k